We have already learned that it is very difficult to profit from a news announcement because, in most instances, such information will almost invariably be factored into the price. Of course, some news events, such as, natural disasters, assassinations, and other random occurrences cannot be foreseen and, therefore, are not discounted. Even in these instances, the market’s response can be very instructive. Good news that fails to induce a rally should be interpreted as a bearish sign. On the other hand, bearish news that does not result in a decline, or causes a decline that is a short-lived one with a quick recovery, is a sign of strength. After President Eisenhower’s heart attack in the early 1950’s, the market sold off, but rallied quickly. Anyone who had bought at “pre-announcement” prices after the President’s heart attack would have done very well. The same was true for investors after John F. Kennedy’s assassination on November 22, 1963. The market’s initial reaction was to sell off sharply, but the selling wave lasted for only a short while and then prices began to climb.

In both examples, the fact that the market was able to digest such horrible news and take it in its stride was a positive factor. In effect, both instances represented a strong signal to buy. This price action after the assassination resulted in two things. First, the initial selling panic got rid of the weak holders-those who reacted in a knee-jerk fashion. When the market moved back above the pre-assassination level, it indicated that this type of selling had been completed. Second, that the market was able to take such potentially destabilizing news in stride demonstrated that it was technically strong and was likely to move higher. At that time, the rationale was that Lyndon Johnson had taken over and appeared to be in control of the situation. Since the market abhors uncertainty, this perception was greeted as a very positive factor. The real reason is more likely that the economy had been in the early stages of a long-term recovery, a factor that the market was very much aware of. Had the economy been on the verge of a recession, it is doubtful whether the market would have taken the news so heroically.

Just contrast the preceding response to the reaction of the market to the resignation of President Nixon during the 1973-1974 recession. When Vice President Gerald Ford assumed the presidency, he performed every bit as well as Johnson. However, the background of rising interest rates and a declining economy meant that stocks faced a bear market. The timing of Nixon’s resignation may have been surprising, but the act was by no means unexpected, unlike Kennedy’s assassination or Eisenhower’s heart attack. Consequently, the market was able to discount this possibility ahead of time. Even though Ford performed well, the tide of the bear market proved to be overwhelming and prices continued to decline. The way that a market responds to a news event, therefore, can be very enlightening in telling us whether the primary price trend is up or down.

Another example of the market’s response to news came on January 16, 1991, at the outbreak of actual hostilities in the Persian Gulf War. Wars are not always predictable, but in this case, the Iraqis had been given a January 15 deadline to withdraw from Kuwait. Since they did not, it was predictable that at some point, the United States and its allies would begin shooting. When war did break out, the market exploded in a manner contrary to almost everyone’s expectation.

Why was this? The answer lies in an analysis of the events and investor perceptions leading up to the war. Remember, the possibilities of war were known well ahead of time. The market had actually bottomed in October 1990. As the deadline grew closer in the opening weeks of 1991, many investors decided to sell, thereby pushing the market down. Not only was there a general sense of uncertainty, but also professional wisdom at the time anticipated a further 100- to 150-point decline on the breakout of hostilities. This eventuality, it was argued, would provide a wonderful buying opportunity. The problem was that everyone else had the same idea. In a rather perverse way, the market responded to the war by exploding. One reason the market did not act as anticipated was that the attack took place at night when the New York market was closed. The initial response in Japan was precisely what people had expected, that is, an initial sell-off followed by a rally. By the time the New York Stock Exchange opened, selling in the global equity markets had given way to a buying frenzy, as the European markets began to explode. This left no chance for American investors to buy at fire-sale prices.

We also have to note that January 15 had been preceded by extreme pessimism. Consequently, a significant number of traders were holding short positions and were forced to cover their borrowings at the opening on January 16. The morning of January 15 was a classic example of market participants all pointed in one direction. Bulls had liquidated and bears were heavily short. As people began to discern that the market was not going to collapse, these positions quickly unwound. The shorts covered and the sold-out bulls, realizing that they were not going to get the chance to get back in at bargain prices, started to reaccumulate their positions.

The rationale that was used to justify the price rise was that the United States was likely to win the war hands down with its superior technology. In addition, consumer confidence, which had been buffeted by the thought of war and the prevailing recession, would bounce back, thereby resulting in a recovery. The fact was that the Federal Reserve had already eased monetary policy, sowing the seeds for a recovery. The explosion of prices on January 16 was, therefore, nothing less than a powerful confirmation that a bull market was underway.

Another point arising out of this example derives from the old Wall Street adage that the market rarely discounts the same event twice. In this instance, the market had sufficient time between August and October 1990 to discount the negative aspects of the war. When hostilities finally broke out, it was time for market participants to focus their attention on something else. This is not surprising when you think about how most people react and worry about predictable events. Most students taking an exam at the end of term begin to worry about it rather early. As a result, they study hard in preparation for the exam. However, the point of greatest concern comes early on and is the triggering point for taking action, which is, studying. If it were possible to measure the degree of anxiety, you would see that it would be most intense just before the process of studying begins. Once the period of study has begun, the students realize that the exam is not as difficult a hurdle as they had first thought. This does not rule out the possibility of renewed nervousness just before the exam. However, the solid preparation that takes place gradually gives them the confidence that they can pass. In a similar way, markets prepare for any ordeal that lies ahead by declining in price. People take defensive action by selling, so that when the event takes place, all those who were concerned have had a chance to get out, leaving the market free to discount the next event.

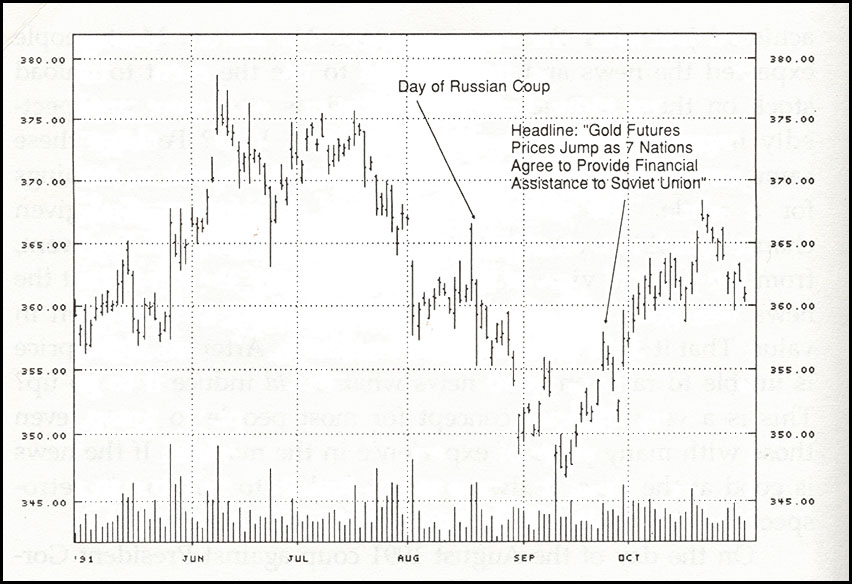

The market’s reaction to news can be very revealing in relation to stories in the financial press. One interesting exercise is to follow feature stories in the Money & Investing section of The Wall Street Journal. The commodity pages, for example, usually focus on a specific commodity with an accompanying chart. The commodity making the headline has usually experienced a sharp price move during the previous day or over the course of the previous two or three weeks. To justify the coverage, the commodity must experience a sharp price movement based on some news event. In Chart 9-1, the gold price clearly experienced a pretty good run prior to September 21st, the day it was featured. The headline on the commodity page read, “Gold Futures Prices Jumps as 7 Nations Agree to Provide Financial Assistance to Soviet Union.” Obviously, the price had been running up in anticipation of this event. Now that it was public knowledge, the chances of additional near-term gains were greatly reduced. Figure 9-1 shows that this did, in fact, prove to be the case, for the price retreated for a few days after the story ran.

Figure 9.1 — The Gold Price – 1991

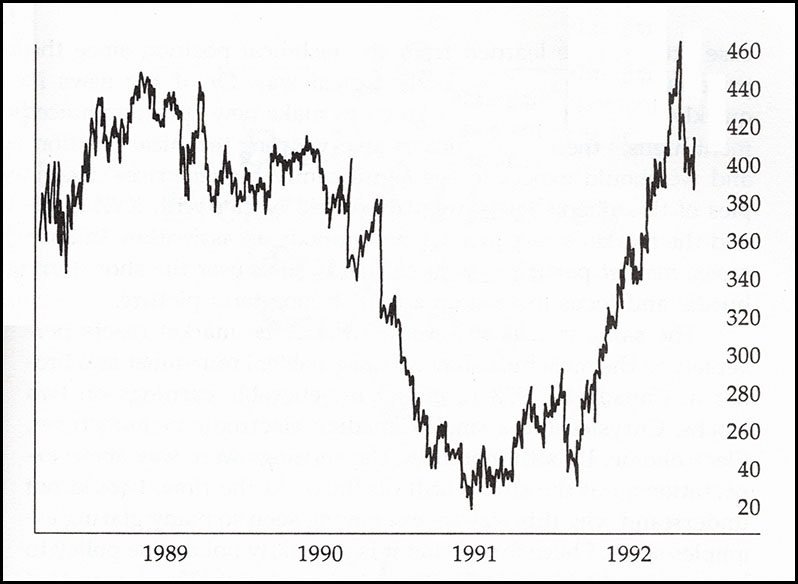

A similar example is shown in Chart 9-2, but this time for wheat following a large drop. The headline reads, “Wheat Futures Prices Skid to a 13-Year Low.” Again, the day the story broke proved to be a good reversal signal. These classic examples are used to prove a point, but as with most approaches to market analysis, The Wall Street Journal cannot be used as a fail-safe contrary mechanism. My point is this: If a market is featured in such a way after a prolonged price trend-be it up or down-this should serve as a warning flag that the trend may be about to make an about-face. If the market in question closes in the opposite direction to that indicated by the story, chances are that the trend will reverse. A news story is but one indicator, but it unquestionably represents a warning about entering the market at that particular time. Generally, the odds will favor those taking the opposite side of the prevailing trend, especially when the headline refers to a 5-year high, 10-year low, and so on.

Figure 9.2 — Wheat Prices 1990

Quite often, we find that a poor earnings announcement results in an initial sell-off, but that the price finishes the day on the plus side. Usually, such action is accompanied by particularly heavy trading volume. The reason often is that investors were expecting the bad news and had been holding off until it was out of the way. Of course, this has the effect of putting pressure on the price because buyers were waiting until the announcement was made. Once the bad news is out, those investors in the know begin to accumulate the stock and the trend reverses.

The price action of stocks-or, in fact, any financial market following an important announcement-can be very revealing. We have already learned that if a market moves in the direction contrary to the course that an uninformed observer might expect that market has already factored in the good or bad news and a new price trend has probably begun. Whether that trend will last for a short or a long time is another matter. On the other hand, the market may be expecting bad news and get even worse news than is generally expected. In this instance, one of two things may happen. Either prices continue to sell off, in which case little can be learned from the technical position since the price is reacting in a perfectly logical way. Or, if the news is quickly absorbed and prices go on to make new “post-announcement highs,” then this indicates a very strong technical position, and we should expect to see significantly higher prices. Examples of this phenomenon were discussed earlier with XYZ stock and the market’s response to the Kennedy assassination. In both cases, market participants were able to look over the short-term hurdle and focus, instead, on a bullish, long-term picture.

The same is true in reverse where the market reacts perversely to the most bullish news imaginable. I remember as a broker in Canada in 1973 receiving unbelievable earnings on two stocks, Chrysler and a small Canadian electronic manufacturer, Electrohome. In both instances, the earnings were way above expectations, but the stocks still declined. At the time, I could not understand why this was so, but having seen so many glaring examples since, I have found that it is generally not a wise policy to ignore such blatant signs of technical weakness. The reason that Chrysler and Electrohome sold off on the good news was that investors were looking ahead to the next recession and were not willing to hold the stocks no matter how good the current news.

Excerpted from “Investment Psychology Explained”

Related Article: How to Profit from News Breaks, Part 1