Patience Is a Profitable Virtue

Most investors and almost all traders and speculators enter the markets believing that they can accumulate profits very quickly. This expectation is fostered by prominent stories in the media featuring successful money managers and mutual funds, or highlighting riches awaiting us if we had only invested in a particular asset. Instant global communication and the rapid dissemination of news create the feeling that unless we act instantly, we risk missing out on a major price move.

These attitudes mean that careful consideration and planning are shoved aside and replaced by impatience and impulsiveness. These temptations inevitably lead to situations where market participants attempt to run before they can walk. Under such circumstances, decisions are made in a manner that is the exact opposite of what was originally intended.

It is probably true that in no other business venture are the majority of participants so impatient for results as in the financial markets. Thoughts of individuals who stuck it rich very quickly become the guiding force of many would-be investors who think that it will be quite simple for them to repeat the process. Thomas Gibson, who wrote The Facts about Speculation in 1923, had already considered this aspect of investing when he said, “The element of time can no more be eliminated from successful speculation than from any other business.”

A major mistake made by most investors and traders is to try to call every market turn. This tactic has very little chance of success. Not only is there a tendency to lose perspective, but most of us operate in cycles, alternating between winning and losing streaks. In attempting to call every trend reversal, we invariably lose our objectivity and lose touch with the markets. It then becomes only a matter of time before we are pushed off balance psychologically. Trying to call every market turn also increases the temptation to act on impulse rather than fact. Decisions that are made infrequently are much more likely to be more thoughtful and reflective. Deliberation gives us a far greater chance of being successful than trying to call every twist and turn in the market.

Always remember: Even if a current opportunity is missed, there will always be another. The best investment decisions are made when the odds are in your favor. You increase those odds when you assess investment possibilities with a cold, indifferent eye and avoid the day-to-day clutter of the marketplace.

Staking Out Your Claim

The daily financial press and electronic media brim with specialists who are willing to offer an opinion at any time on any of the markets or stocks that they cover. Sally from Financial Daily calls up Harry, a commodities analyst and asks for his opinion no cocoa, for example. Harry may have no firm opinion one way or the other on the cocoa market, but he volunteers his view anyway, purely because he will obtain some profitable exposure in the paper for both him and his firm. Since he has no strong facts to justify his opinion, the chances are good that his forecast will be inaccurate. Still, it will be held up as authoritative “expert opinion.”

He would have served himself and everyone else much better had he politely declined the interview, adding that he would call Sally the next time he saw something of importance developing. Under these ground rules, Harry would choose the appropriate time to put forward an informed opinion rather than an off-the-cuff one. This is how guerrilla warfare is successfully carried out. Guerrillas, by definition, are always outnumbered by the army they are fighting so they have to even the odds by getting the enemy to come to them. They are the ones who choose the time and place for battle. If they decided to fight every time they came into contact with the enemy, they would run the risk of an open battle where the army would have an overwhelming advantage.

The same principle applies to people who comment on market activity or who are actively involved as traders or investors. Guerrillas have patience, and so should market participants. The degree of patience involved will depend on the time horizon over which the investment or trade is being made. For a futures trader, patience may demand a wait of one or two weeks; for the one-day trader, it could mean four or five hours; and for a long-term, conservative investor, the time horizon could extend beyond a year. The amount of time is immaterial. The guiding principle is that you should have the patience to wait until all your ducks are in a row. It is difficult making money in the markets at the best of times, so make sure that you-not the markets-decide when the time has come for trading or investing.

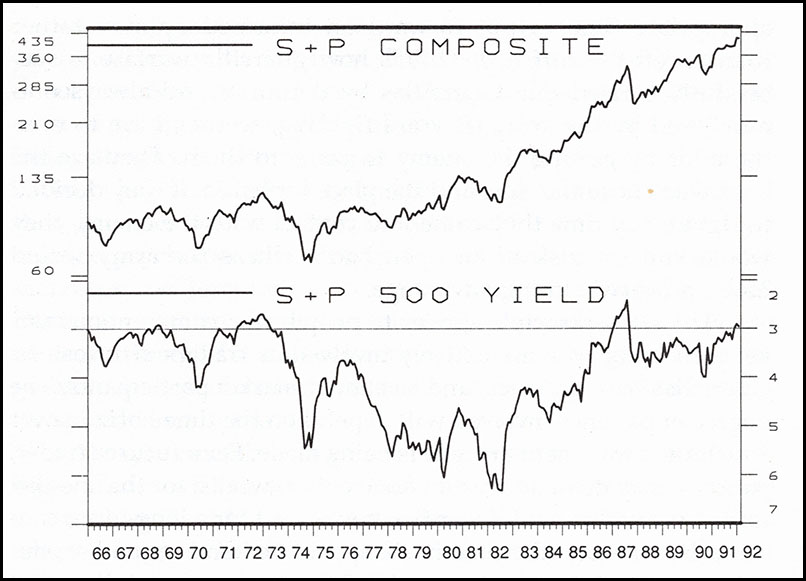

Figure 5.1 — S&P Composite versus Its Dividend Yield 1966 – 1992

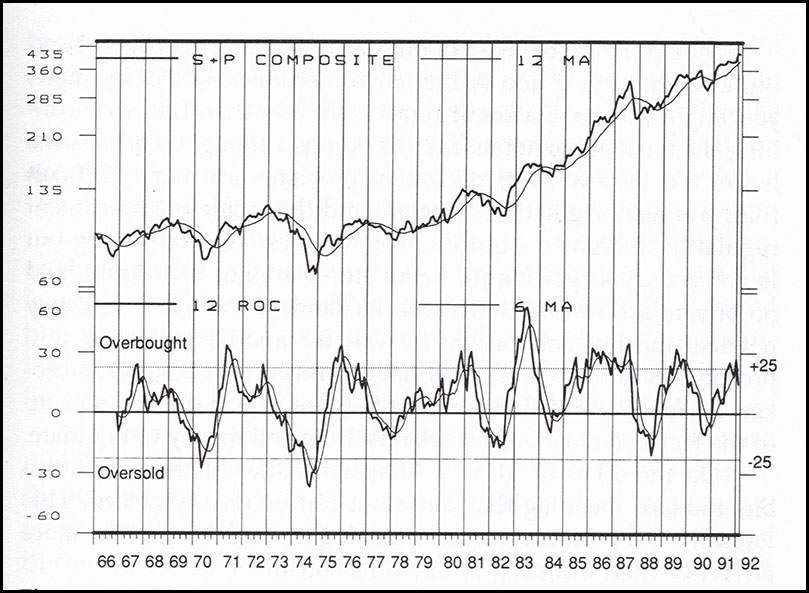

Long-term investors who base their investment decisions on fundamental analyses need to wait for the market to become undervalued. One useful valuation measure is the dividend yield no the Standard & Poor Composite Index. In this respect, Figure 5-1 shows that a dividend yield of 6% or greater has traditionally been a good low-risk entry point. For individuals sympathetic to the technical approach, a reading in the 12-month rate of change indicator below –25% would represent a similar benchmark. These entry points are shown in Figure 5-2.

Figure 5.2 — S&P Composite and a 12-month Rate of Change

Neither of these indicators is infallible and that is why both the technically and value-oriented individuals, in this example, must also consider the position of several other indicators in their decision-making process. The approach or time frame makes no difference. The important thing is to make sure that you have the patience to wait for a low-risk entry point for your specific system and time horizon. There is nothing in the rule book that says you have to invest. Your impulses may encourage you to get in. Disregard them. Let your head make the decisions.

The first principle in applying patience, then, is having the patience not to get in too soon. When you are in a position to conclude that most of the indicators or conditions that are associated with a major bottom are in place, this will give you a far higher degree of confidence to stay with the trade or investment when things get rough.

When I talk about a bottom, the term “major” in this context refers to a significant point in your own personal time frame. Thus, if you are a conservative, long-term investor, a major bottom in bonds or stock may occur only every other year, as the appropriate juncture in the four-year business cycle is reached. On the other hand, a major bottom for a short-term futures trader may appear once a month.

Why Playing the Markets Is Different from Other Businesses

A portfolio or trading account at a broker should be run just as any other business. Operating principles should be established, goals should be set, plans should be followed, and the risks and rewards from potential transactions ascertained. We have already discussed that the perceived cost of entry into the investment business is far lower than any other business and that this encourages the inexperienced to try their hand. People who would never take a plunge in a business in the “real” economy are often willing to commit a large proportion of their net worth to the markets. This is due not only to the ease of entry and the view that playing the markets is relatively simple, but also to the fact that markets are very liquid.

Let us compare the ease of buying and selling a stock or bond with that of buying and selling any other business. For example, you might purchase a small retail store and then find that running the business is not as easy as you had thought. Perhaps the hours are inconvenient, personnel problems are more difficult than you had originally estimated, and the tangle of government regulations becomes a burden. For whatever reason, getting out is not as easy as getting in. Retail stores are not that liquid, and no buyers are waiting with cash in hand. If there are, you may not like the bid and decide to wait for another one. You will probably have to pay a substantial commission to a business broker, normally 10% of the price. All these considerations add up to the fact that most businesses take time and money to liquidate.

On the other hand, in a financial market, there is always a bid-and-ask, meaning that our asset can be readily priced. This liquidity is a powerful reason investing in the market is far more attractive than investing in any other business.

Unfortunately, this readily available pricing mechanism also has its downside. Every time you look at price quotes in the paper or call your broker, you know exactly how much your investment is worth. You can watch it when the price goes up, which will make you happy; and you can follow it when it goes down, which will depress you. This constant access to the pricing mechanism draws you into the market emotionally. Since it is very easy and relatively inexpensive to liquidate the position when your “business” temporarily hits the skids, the temptation is to do just that. So, you sell. The odds are strong that you are responding emotionally to the fluctuation in the price, rather than the change in the underlying market conditions.

On the other hand, consider the example of a person who buys a manufacturing business for which there is no easily available pricing mechanism. Initially, he may find that things go well. The cost-cutting measures that he takes immediately increase his cash flow. He uses the savings as capital to invest in more plant capacity and equipment to spur future growth. After a while, though, he runs into problems; sales slowdown and the economy looks weak. Our entrepreneur may decide to sell his business, but he is less likely to do so because he cannot find a suitable buyer. Eventually, he no longer experiences the urge to sell and hangs on until retirement several years later. When he finally liquidates the business after 15 years, he finds that he has appreciate in value to a considerable extent and he now has a wonderful nest egg. In this example, the business owner concentrated on running his business. He was not constantly looking to see how much it was worth each day for the principal reason that he couldn’t. The nature of his business was such that it forced him to be patient. He could, of course, have sold it any time during those 15 years, but the costs and difficulties involved in selling were strong enough to keep him from taking that step.

Investing in the stock market, on the other hand, is much different. There, the constant price fluctuations, the market’s addictive response to the news, and its emphasis on short-term performance drag us in by our emotions, causing us to make hasty and ill-considered decisions. The liquidity and pricing mechanism that make it easy to enter the financial markets have their downside: They literally try our patience. We have a tendency to think that to be successful, we need to have constant access to prices and other information. Too much assess actually works against our best interests.

Excerpted from “Investment Psychology Explained”

Related Article: Knowing Yourself, Part 2