Conventional wisdom has it that the Fed will lower rates three times in 2024, as inflation dissipates. That may eventually be true, but our business cycle work suggests that a rate hike has a greater probability of materializing first. But let’s begin this article with a look at the current phase of the business cycle to see where we are, and then opine as to what might come next.

The Current Business Cycle Phase is Bullish for Commodities

At Pring Turner we believe that the business cycle is nothing more or less than a set series of chronological sequences. In simplistic terms, it begins with falling interest rates as a recession unfolds. These lower rates stimulate the purchase of new homes, which need to be furnished. The increased demand for consumer durables eventually eats up spare capacity, which leads to the initiation of capital spending projects. As delivery times shorten, tightness in the system drives up commodity prices and interest rates. Eventually those rates feed back into the economy, and are followed by a recession, and a new cycle begins.

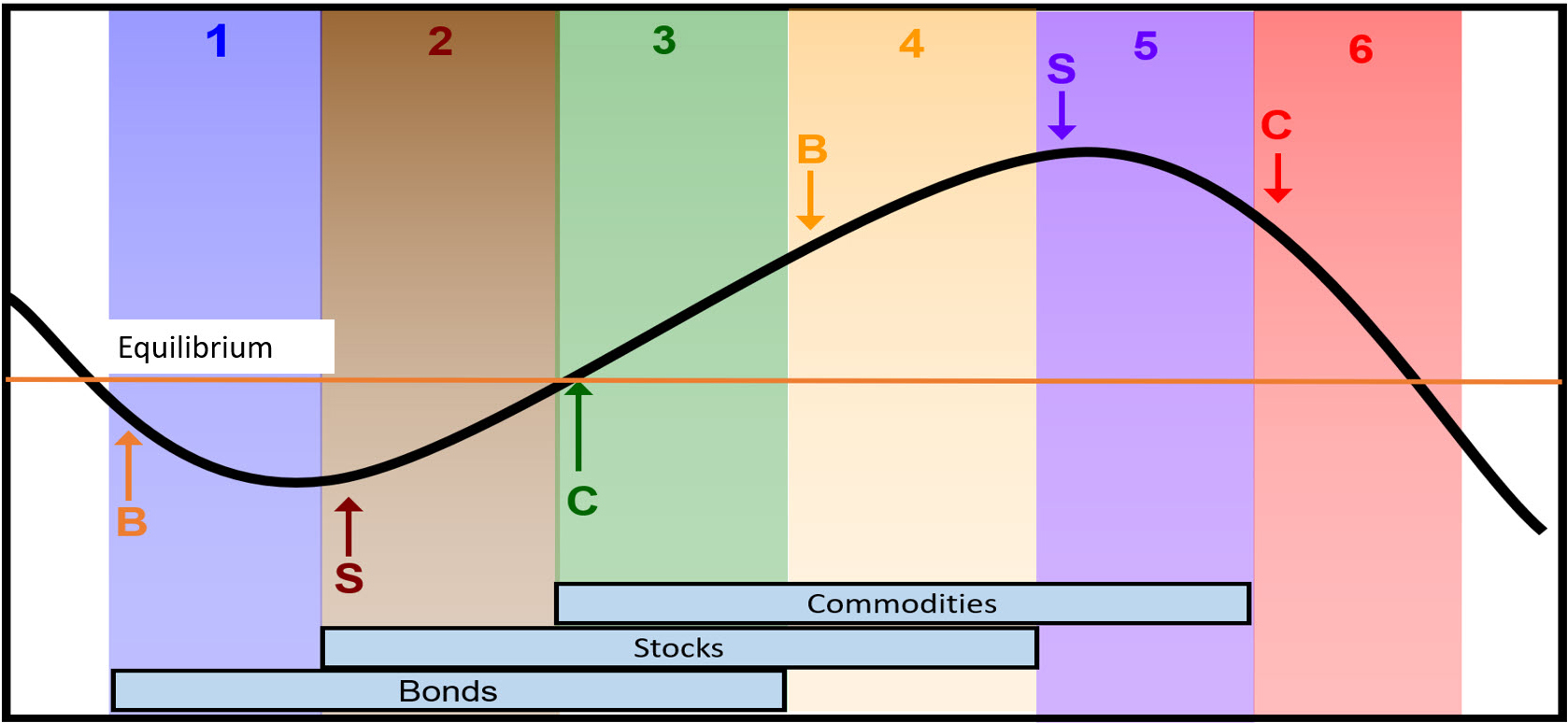

Fortunately for market watchers, this chronological sequence includes the primary trend turning points for bonds, stocks and commodities, as shown in the diagram. Since there are three markets and each has two turning points the cycle may be conveniently broken down into six stages or seasons. The diagram shows each stage is suitable for different asset mixes. Stage 2, for example, favors stocks and bonds, whereas Stage 4 sees commodities and commodity sensitive sectors outperform a bearish bond market. A deeper explanation of this chronological business cycle concept can be found here. The prevailing stage of the cycle are determined by proprietary models or barometers, which are published monthly in the Intermarket Review.

Figure 1 — Turning Points for Bonds, Stocks and Commodities in an Idealized Business Cycle

The business cycle moved to Stage 4 in April. This is the most inflationary phase for commodities.

The business cycle moved to Stage 4 in April. This is the most inflationary phase for commodities.

To backtrack slightly, at the end of October the Bond and Stock Barometers were bullish and commodities negative, thereby signaling a Stage 2. That’s a phase of the cycle typically offering the best equity returns. The post October rally being a classic example. Then, at the end of February, our Inflation model featured in Chart 1, went bullish indicating a transition to Stage 3, which is positive for all three markets.

April has seen things move ahead rapidly, as the CRB Spot Raw industrials , a key component of the Bond and Inflation models, closed the month above its 12-month moving average thereby pushing the cycle into Stage 4. Since the mid-1950’s, Stage 4 has averaged just under 7-months. It’s a far more inflationary phase than its predecessor, as the average annualized monthly return on bonds, excluding interest, has been -8%. A similar measure for commodities comes in at +13%. Stage 4 also favors earnings driven sectors. For instance, Metals, Oil and Gas and semi-conductors averaged +18%, +17% +15% respectively. The star commodity performer was copper with a gain of +25%. Crude oil also did well at +16%. Should the Fed decide to lower rates in a Stage 4 environment, it would be like pouring gasoline on a smoldering fire.

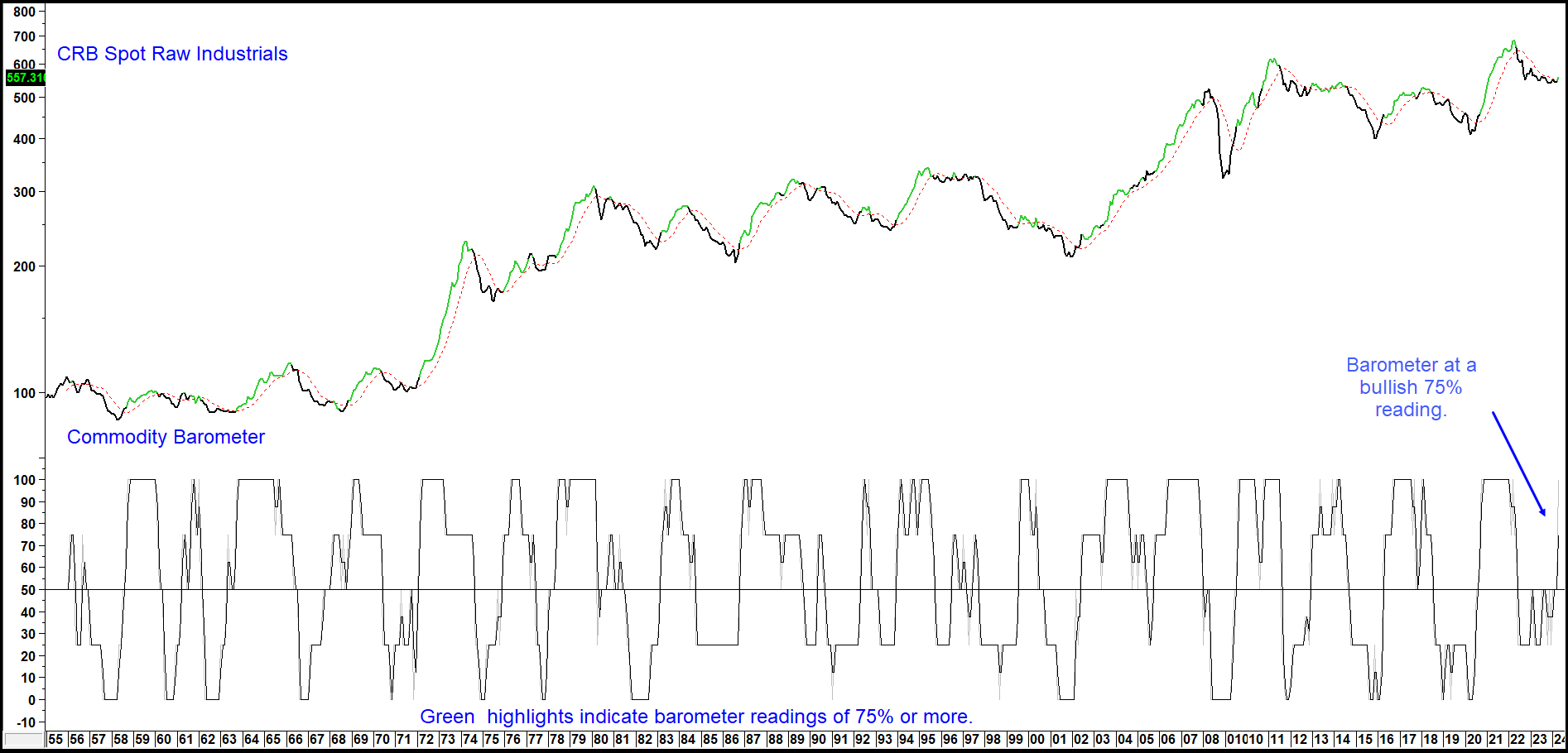

Chart 1 — Pring Turner Inflation Barometer

The Barometer is currently bullish for industrial commodity prices and inflation.

The Barometer is currently bullish for industrial commodity prices and inflation.

Relating Gold, Commodities, and the PPI to the CPI

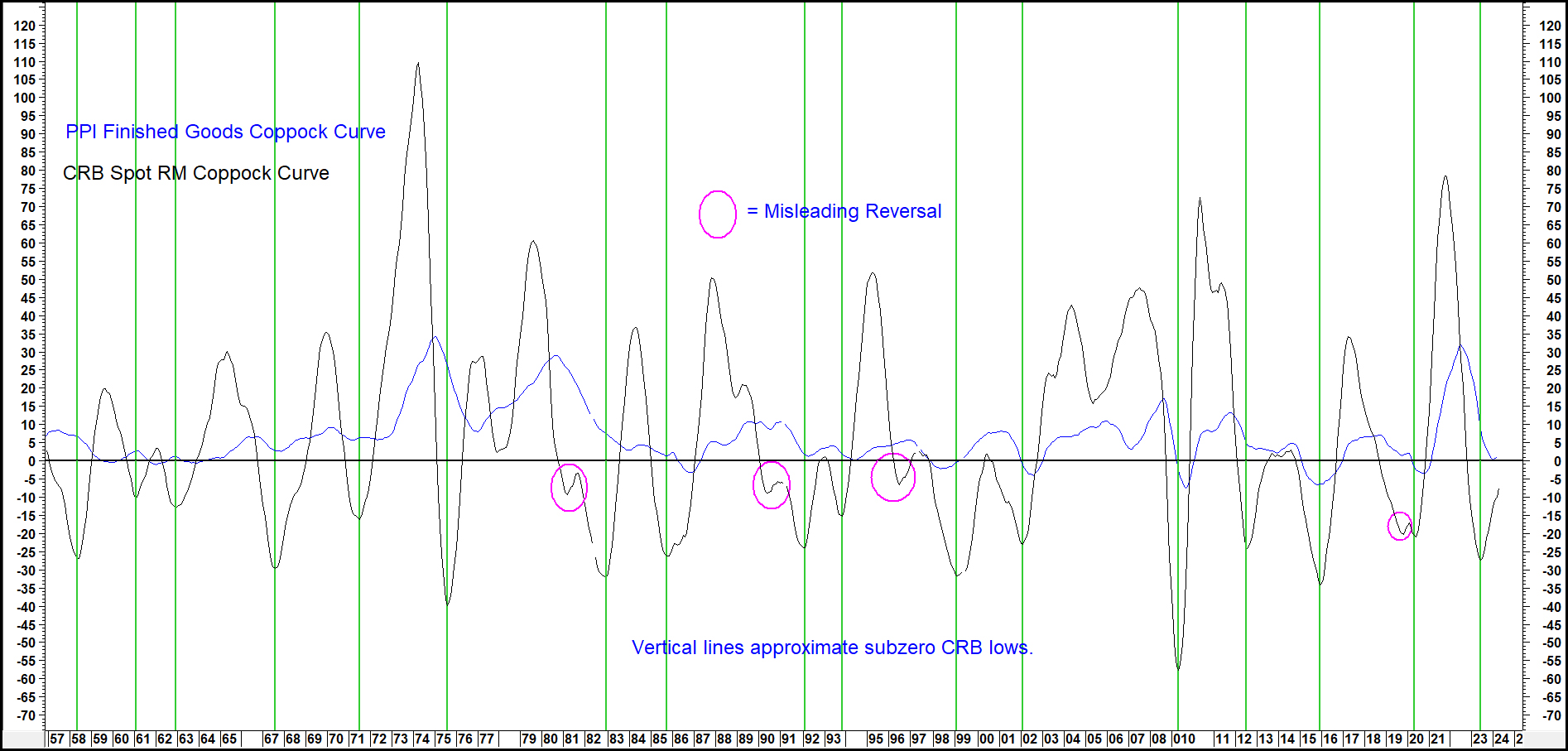

The chronological sequence approach can be taken a step further by applying it to turning points in gold, industrial commodities, the Producer Price Index (PPI) for finished goods and finally the Consumer Price Index (CPI) itself.

Gold is useful because it is a leading indicator for industrial commodities. This relationship is demonstrated by the vertical lines in Chart 2, which intersect with the lows for the gold momentum. The blue horizontal arrows indicate that commodity momentum consistently lags that for gold at cyclical lows. Gold momentum started the cycle a year ago and that for industrial commodity prices has now started to turn up. This relationship does not tell us anything concerning the magnitude of the implied commodity rally, merely that it is consistent with a Stage 3 or Stage 4 environment. However, gold’s recent long-term price breakout combined with its on-going bullish momentum suggests there is plenty of unrealized commodity upside potential if this relationship holds.

Chart 2 — Gold versus Commodity Momentum

Gold momentum typically leads commodity momentum at cyclic lows.

Gold momentum typically leads commodity momentum at cyclic lows.

A Bullish Commodity Market Has Serious Implications for CPI

Annualized CPI inflation moves in waves that are often independent of the economic cycle. The most recent up wave peaked in June of 2022 and has been working its way lower ever since. That said, there are signs a new up wave may be developing. A simple chronological approach helps explain. History shows CPI waves have been consistently preceded first, by industrial commodities and then by the PPI for finished goods. Chart 3 compares a Coppock Curve (momentum) for the CRB Spot Raw Industrials and the PPI for finished goods. The vertical lines approximate the CRB lows and the slanting arrows their lead characteristics. The ellipses tell us this is not a perfect relationship. Nevertheless, in most situations CRB momentum leads that for the PPI.

Chart 3 — CRB Spot Raw Industrials versus PPI Finished Goods Momentum

Industrial Commodity Momentum consistently leads that for the Finished Goods PPI.

Industrial Commodity Momentum consistently leads that for the Finished Goods PPI.

The latest data shows a miniscule reversal in the PPI following a decisive one for the CRB. The cycle appears to be on track!

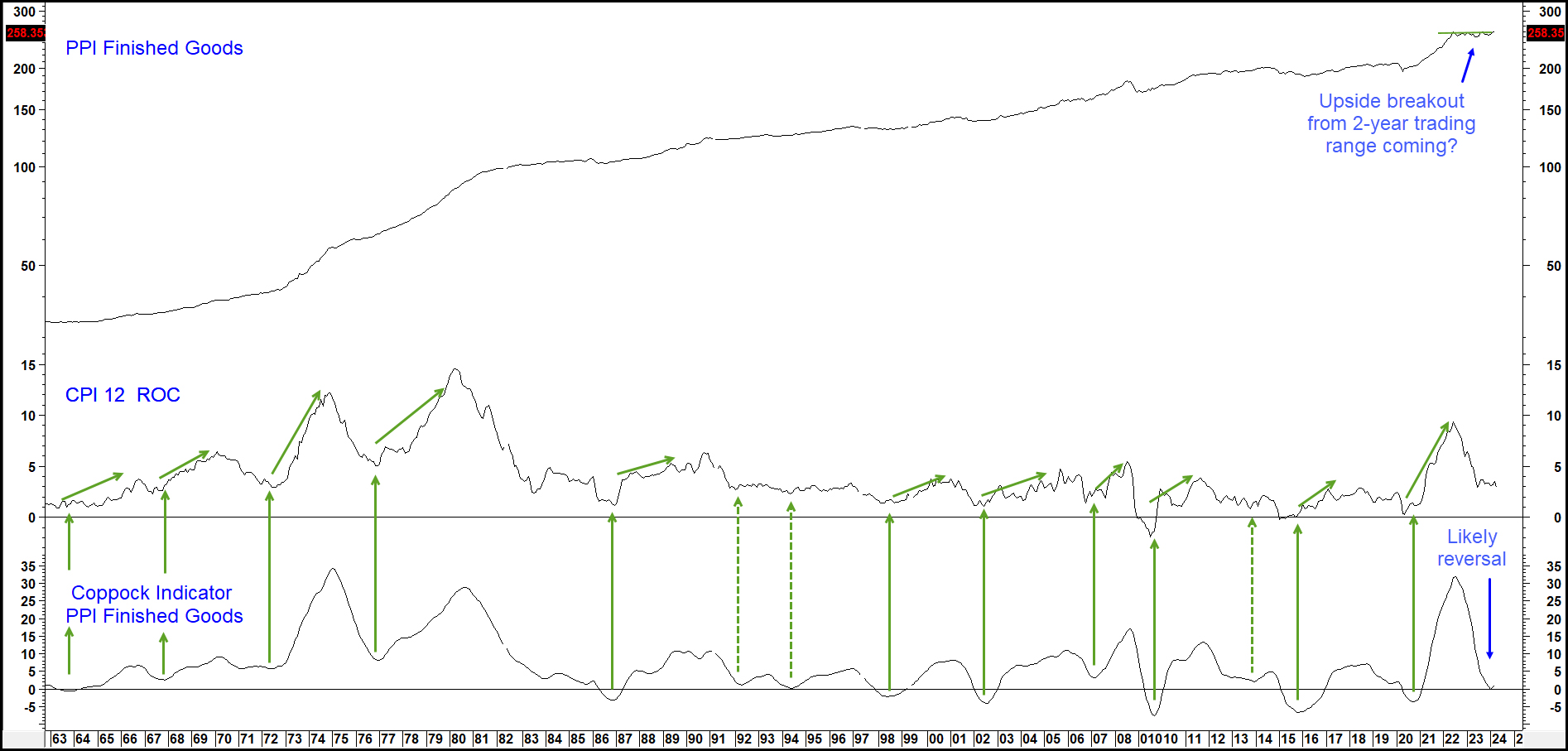

Chart 4 shows that potential reversal is crucial from a CPI point of view. That’s because the vertical lines indicate positive PPI reversals have been consistently followed by an up wave in CPI inflation. Failed reversals have been identified by the dashed lines. Since this is a very smooth series, it seems likely that the recent gentle upturn is genuine, especially as the PPI Index itself, as reported for March, is close to breaking out from its post 2022 trading range. The firming up of commodity prices in April and the transition to Stage 4 enhance those chances, when the next report is published in early May.

Chart 4 — PPI versus CPI Inflation

If a tentative PPI momentum reversal becomes more decisive a new CPI inflationary up wave is likely.

If a tentative PPI momentum reversal becomes more decisive a new CPI inflationary up wave is likely.

What is in doubt, is the up-wave’s magnitude and duration and whether it would be sufficiently troubling to cause the Fed to raise rates in a politically charged election year.

If another wave of higher inflation does materialize and the Fed temporizes, as it did in 2021 that would push yields and inflation higher, finally bringing about the long-awaited recession and causing it to be far more painful than would otherwise be the case. Fortunately, a plethora of long-term stock market indicators remain positive, and that suggests it will be a while before rising rates and commodity price inflation adversely feed back into the economy and render stocks vulnerable in a Stage 5 environment. Following our business cycle indicators will not guarantee success but will certainly increase the odds of recognizing when the cycle’s more treacherous phases become apparent.